Malawi drops plan to impose tax on mobile-money transactions

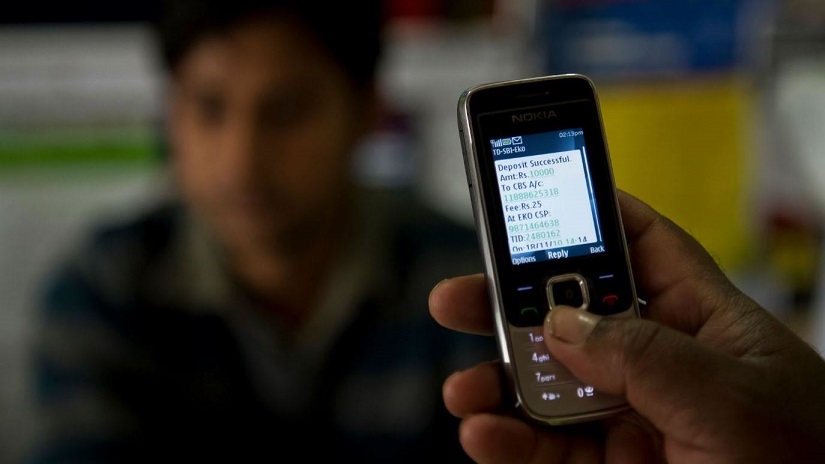

The Malawian government has dropped it plan to impose a 1% withholding tax on non-bank mobile-money transactions.

The proposed new tax was announced by Minister of Finance, Economic Planning and Development Joseph Mwanamvekha in his budget speech last month, sparking criticism from some of the country’s lawmakers and industry players.

Mwanamvekha told lawmakers on Monday that the government will now seek to introduce a 20% withholding tax on interest earned by trust funds that mobile companies set up to finance social programs.

The Chief Executive Officer of Telekom Networks Malawi Plc, the country’s biggest phone operator, Michiel Buitelaar, wrote a letter to Mwanamvekha expressing concern that the new tax would increase the cost of mobile-money transactions and stifle financial inclusion.

Mobile-money transactions in Malawi increased by 8.2% to 7 million in the 3 months through June, according to a report by the Reserve Bank of Malawi, while the value rose 39% to 1 billion kwacha ($1.4 million).

The report also showed that there are 45,929 mobile money agents, 81.1% of whom are located in urban and semi-urban areas while 18.9% are in rural areas.