Entrepreneurs worried as Kenya plans to introduce digital tax

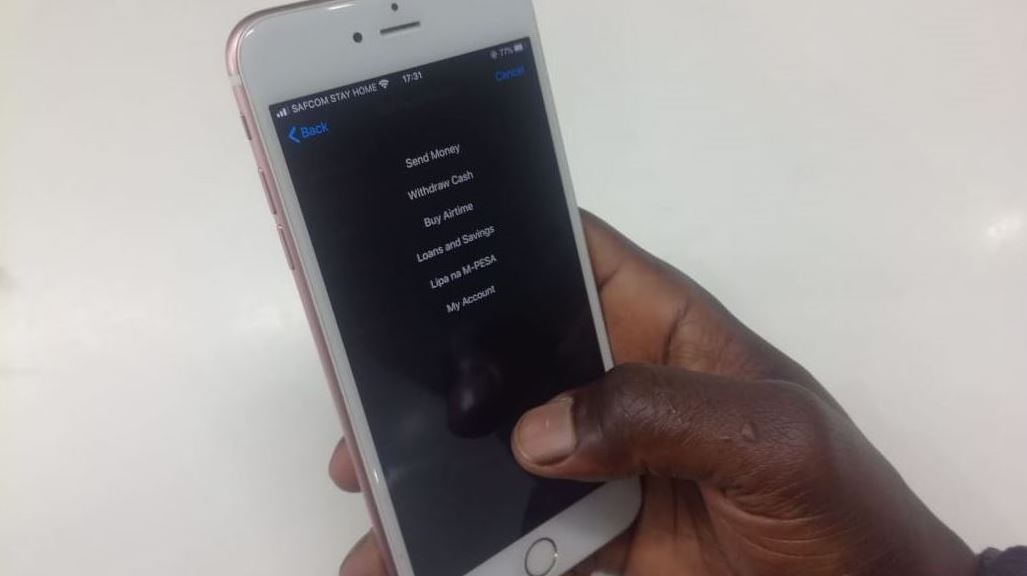

International and local digital businesses in Kenya will from January 2021 start paying tax on their transactions. The entrepreneurs warned that the new tax may slow down the growth of the sector at a time when citizens are being encouraged to embrace online trade to curb the spread of COVID-19.

While unveiling the budget for the 2020-2021 fiscal year on Thursday, Ukur Yatani, the treasury secretary, said the government will introduce “digital service tax” for online transactions.

“The tax shall be applicable at the rate of 1.5 percent of the gross transaction value of a person or firm whose income from the provision of services is derived from or accrues in Kenya through a digital marketplace,” said Yatani.

The tax targets international internet giants that include Amazon, Alibaba, and Netflix as well as local firms, including startups.

The new taxation seeks to ride on the explosion of digital businesses in the East African nation. Kenya has witnessed a rise in online businesses particularly during the pandemic with citizens taking on to the platforms to buy food, clothes, alcohol, shoes, household goods and furniture, among other items.

But some entrepreneurs are worried that the introduction of the digital service tax may affect the sector at a critical time.

Joseph Macharia, who runs Mkulima Young, an online agricultural marketplace, observed that most digital marketplaces only facilitate business by connecting buyers and sellers but don’t charge transaction fees.

“But the tax may force us to charge a commission on items sold, depending on the price which will force them to adopt new business models,” he said.

Bernard Mwaso of Edell IT Solution, a software development startup in Nairobi, said that the tax may affect the uptake of online services and trade and slow down the growth of the sector.

“What the tax will do is make online goods costly because the digital businesses will pass the charges to consumers,” he said.

He noted that consumers may, therefore, find online goods much costlier if they add to the product price courier charges.

“Consumers in Kenya pay up to three U.S. dollars courier fees on small items like phones depending on their locations. This will make it harder for online businesses to compete with other shops that include supermarkets where people walk in and buy,” he said.

He observed that most online marketplaces are still nascent businesses and they do not charge transaction fees, hoping to grow the number of users and then cash in later.

Deloitte East Africa in an analysis also said the “digital service tax” will pose administrative challenges for Kenya.