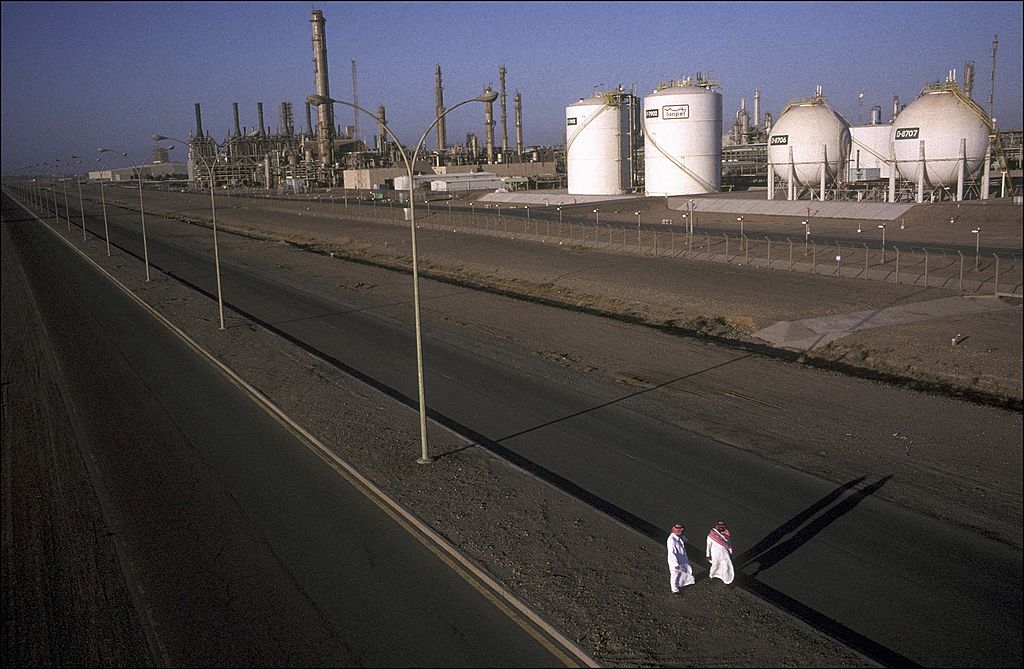

Oil prices shoots up after an attack on Saudi oil facilities

But prices came off their peaks after U.S. President Donald Trump authorized the use of the country’s emergency stockpile to ensure a stable supply.

Brent crude futures, the international benchmark for the global oil market, rose by as much as 19.5% to $71.95 per barrel, the biggest intra-day jump since Jan. 14, 1991.

By 0633 GMT, the front-month contract was at $66.31, up to $6.09, or 10.1%, from its previous close.

Saudi Arabia is the world’s biggest oil exporter and the attack on state-owned producer Saudi Aramco’s crude processing facilities at Abqaiq and Khurais has cut output by 5.7 million barrels per day.

According to a source close to the matter and speaking to Reuters, the return to full oil capacity could take “weeks, not days.”

“We think the attacks would be a wake-up call for investors, who have failed to price in risk within the price of crude. Although global supply will contract in the near term, the United States has the ability to supply this contraction,” said Hue Frame, managing director at Frame Funds in Sydney.

Countries which are major importers of Saudi crude, such as India, China and Indonesia, will be the most vulnerable to the oil supply disruption, Frame said.

Meanwhile, South Korea said on Monday that it would consider releasing oil from its strategic oil reserves if circumstances around crude oil imports worsen in the wake of Saturday’s attack on Saudi Arabia’s oil facilities.

The attack on plants in the heartland of Saudi Arabia’s oil industry, including the world’s biggest petroleum-processing facility at Abqaiq, came from the direction of Iran, and cruise missiles may have been used, according to a senior U.S. official.